Self-Supervised Learning of Accounting Data Representations for Downstream Audit Tasks

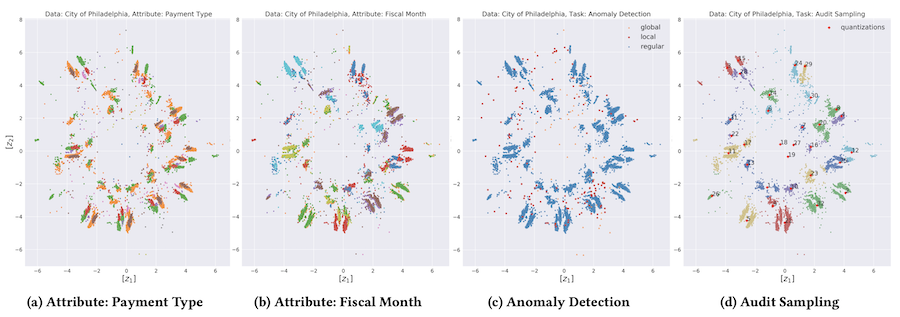

International audit standards require the direct assessment of a financial statement’s underlying accounting transactions, referred to as journal entries. Recently, driven by the advances in artificial intelligence, deep learning inspired audit techniques have emerged in the field of auditing vast quantities of journal entry data. Nowadays, the majority of such methods rely on a set of specialized models, each trained for a particular audit task. In this work we propose a contrastive self-supervised learning framework designed to learn audit task invariant accounting data representations. The framework encompasses deliberate interacting data augmentation policies that utilize the attribute characteristics of journal entry data. We evaluate the framework on two real-world datasets of city payments and transfer the learned representations to three downstream audit tasks: anomaly detection, audit sampling, and audit documentation. Our experimental results provide empirical evidence that the proposed framework offers the ability to increase the efficiency of audits by learning rich and interpretable multi-task representations.